Maybank stock code 1155

Price RM7.55

12 Months high 7.650 (08-Mar-10)

12 Months low 3.820 (08-Apr-09)

Maybank covered in this blog before when its' still within a range bound of RM6.60 - RM7.05. Read it: Maybank- stock code 1155

Mentioned on that post:

"It's buy on rebound near support (6.60) if that what you are looking for, with a couple of weeks holding period allowance."

Yes, it fell to RM6.60 and rebounded and staged RM7.05 level breakout. After rebounded, it took several weeks to go as high as RM7.65.

Maybank is a index-linked heavyweight counter, looking at the chart it can be categorized as a momentum stock not different from FBM KLCI trend. Breakout signal and 'trend is your friend' adage are good ones to apply with this stock.

Right now it need a breakout form recent high as a signal new fresh buying. Which I think that come soon especially with:

1. Its latest development,

2.Recent research house revised target price. For example Hwang DBS Vickers revised Maybank target price to RM9.00. (more research houses are expected to revised its target)

3. Last but not least, CIMB has moved very far which made Maybank as the next likely KLCI heavyweight stock candidate to be pushed.

4.Maybank is a laggard with low foreign shareholding (11%) vs. CIMB (40%) and Public Bank (26%). (data by HDBS Vickers)

Below: Maybank Daily chart (click to enlarge)

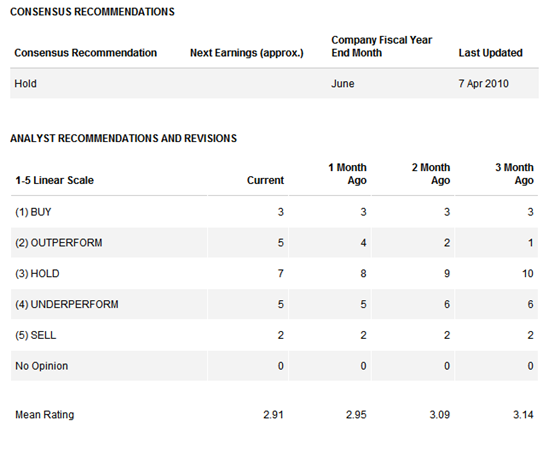

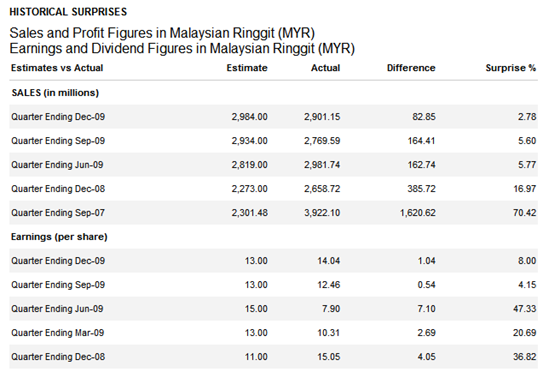

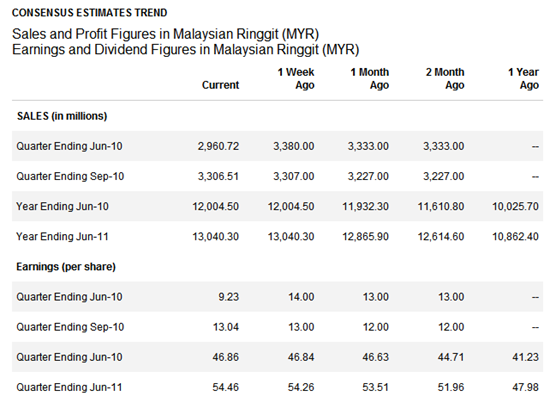

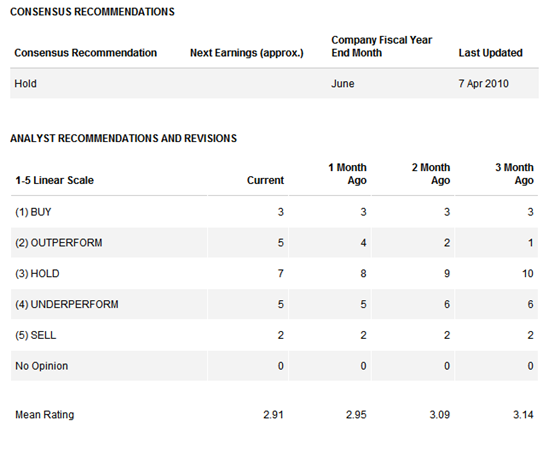

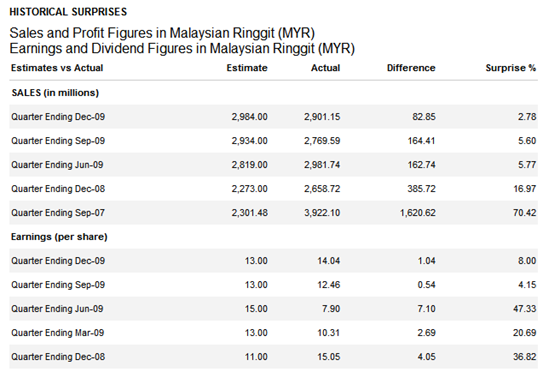

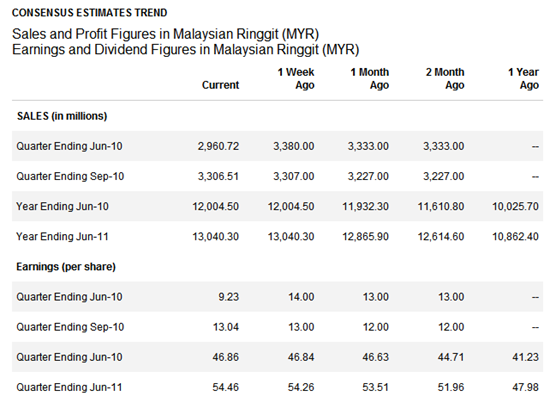

MAYBANK CONSENSUS RECOMENDATIONS ANALYSIS - source: REUTERS

Check other data : thestarbiz maybank

Maybank stock code 1155

Price RM7.55

12 Months high 7.650 (08-Mar-10)

12 Months low 3.820 (08-Apr-09)

Maybank covered in this blog before when its' still within a range bound of RM6.60 - RM7.05. Read it: Maybank- stock code 1155

Mentioned on that post:

"It's buy on rebound near support (6.60) if that what you are looking for, with a couple of weeks holding period allowance."

Yes, it fell to RM6.60 and rebounded and staged RM7.05 level breakout. After rebounded, it took several weeks to go as high as RM7.65.

Maybank is a index-linked heavyweight counter, looking at the chart it can be categorized as a momentum stock not different from FBM KLCI trend. Breakout signal and 'trend is your friend' adage are good ones to apply with this stock.

Right now it need a breakout form recent high as a signal new fresh buying. Which I think that come soon especially with:

1. Its latest development,

2.Recent research house revised target price. For example Hwang DBS Vickers revised Maybank target price to RM9.00. (more research houses are expected to revised its target)

3. Last but not least, CIMB has moved very far which made Maybank as the next likely KLCI heavyweight stock candidate to be pushed.

4.Maybank is a laggard with low foreign shareholding (11%) vs. CIMB (40%) and Public Bank (26%). (data by HDBS Vickers)

Below: Maybank Daily chart (click to enlarge)

MAYBANK CONSENSUS RECOMENDATIONS ANALYSIS - source: REUTERS

Check other data : thestarbiz maybank

RSS Feed

RSS Feed Twitter

Twitter 3:11 PM

3:11 PM

Joehari Matt

Joehari Matt

2 comments:

UOB Kay Hian Research on 16th April 2010 upgraded Maybank to buy with a 12-month target RM8.80

[LATEST MAYBANK ANALYSIS] Coronavirus effect: https://malaysiainvestment88.blogspot.com/2020/01/maybank-drops-opr-cut-and-coronavirus.html

Post a Comment