As previously mentioned in this blog (read here: Sunway)

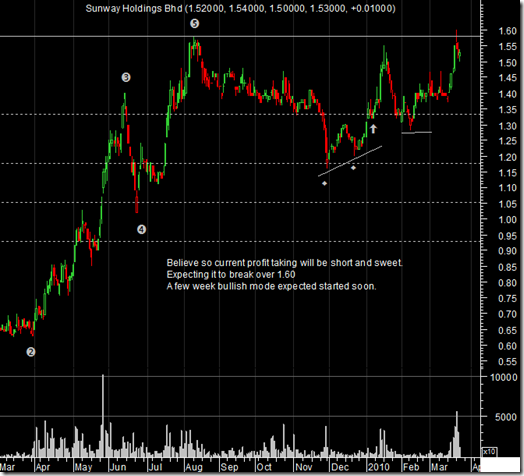

"Any rebound now is a buy signal but I think i will correct a little more to to within 1.25 zone. That's the likely zone to rebound"

It did rebound at 1.28.

"Believe so the correction phase is over and now heading to 1.60" "Any rebound now is a buy signal but I think i will correct a little more to to within 1.25 zone. That's the likely zone to rebound"

It did rebound at 1.28.

It rose to to 1.60 and now in a profit taking phase.

Believe so the current profit taking will be mild, short and sweet. Expecting it to break over 1.60 A few weeks bullish mode expected soon.

Other info : http://biz.thestar.com.my/sunway

Other technical analysis: http://klse-online.blogspot.com/sunway

Below: Sunway Holding Bhd (click to enlarge)

As previously mentioned in this blog (read here: Sunway)

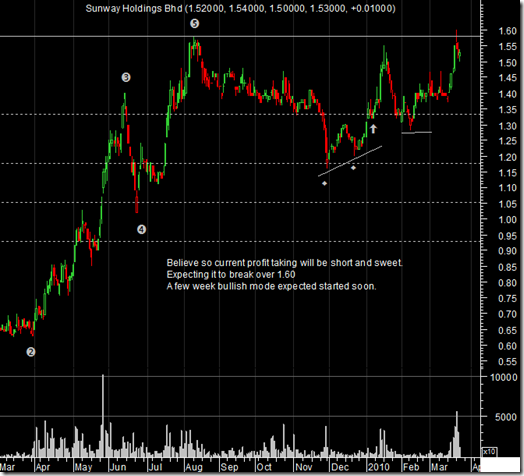

"Any rebound now is a buy signal but I think i will correct a little more to to within 1.25 zone. That's the likely zone to rebound"

It did rebound at 1.28.

"Believe so the correction phase is over and now heading to 1.60" "Any rebound now is a buy signal but I think i will correct a little more to to within 1.25 zone. That's the likely zone to rebound"

It did rebound at 1.28.

It rose to to 1.60 and now in a profit taking phase.

Believe so the current profit taking will be mild, short and sweet. Expecting it to break over 1.60 A few weeks bullish mode expected soon.

Other info : http://biz.thestar.com.my/sunway

Other technical analysis: http://klse-online.blogspot.com/sunway

Below: Sunway Holding Bhd (click to enlarge)

RSS Feed

RSS Feed Twitter

Twitter 8:28 AM

8:28 AM

Joehari Matt

Joehari Matt

3 comments:

This development could affect (minimal) SUNWAY:

Bina puri LCCT terminal project

TOday:

Hwang DBS Vickers Research has a Buy call on Sunway Holdings with a sum-of-parts target price of RM1.95

Sunway had on Thursday, April 1 accepted the letter of award for a RM88 million contract from KLCC Holding Sdn Bhd to build Phase 2 of Impiana KLCC Development.

“This is Sunway’s second contract win for 2010 bringing YTD contract wins to RM110 million. This forms c.14% of our RM800m order win assumption for FY10 and will lift Sunway’s orderbook by 4% to RM2.5 billion,” said HDBSVR in a research note on Friday.

Assuming a margin of 8%, total pre-tax profit over the duration of the contract amounts to RM7 million or 1% and 3% of FY10 and FY11 core pretax profit, it said.

“We continue to like Sunway as a small-mid cap pick to the sector. Earnings deliverance has been consistent while other key catalysts are a revival in India infrastructure contracts and the 10MP which would provide more clarity on contract flows,” it said.

(Edge)

Sunway grabbed Impiana KLCC project maintain buy by HwangDBS Vickers : read: SUNWAY

Post a Comment